News and Updates

Stay Informed, Stay Connected

Get the latest updates on digital payments, industry milestones, and PPMI's ongoing efforts to empower the Philippines' financial landscape. From major announcements to insightful articles, keep up with the progress shaping the future of payments.

PPMI Annual Membership Meeting

June 16, 2025

Philippine Payments Management Inc. Holds 2024 Annual Membership Meeting Manila, Philippines - June 16, 2025

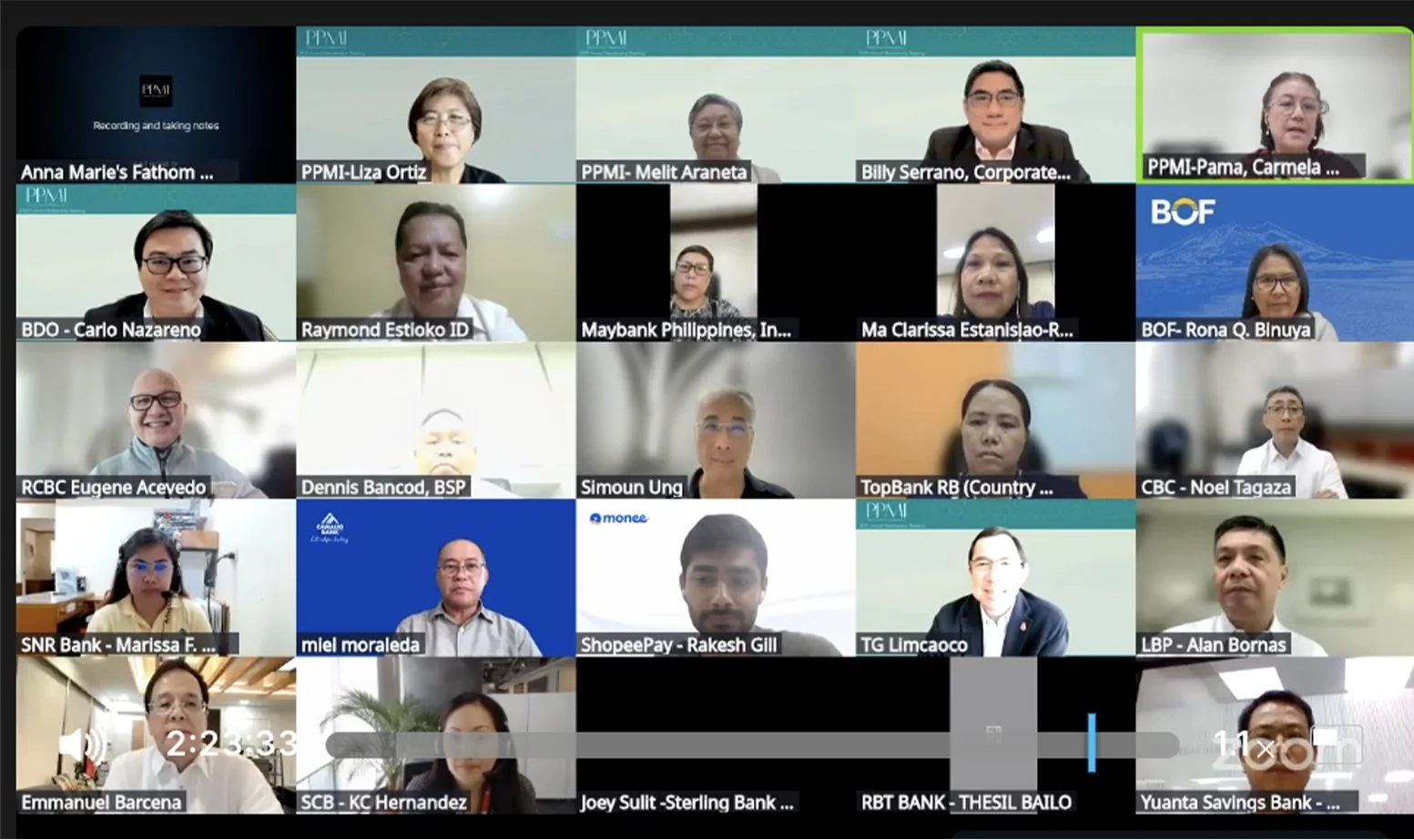

In a virtual gathering on June 16, 2025, the Philippines Payments Management Inc. (PPMI)—the duly accredited payment System Management Body (PSMB) under the Bangko Sentral ng Pilipinas (BSP) National Retail Payment System (NRPS) Framework—held its 2024 Annual Membership Meeting.

The event brought together key stakeholders in the financial industry, led by PPMI Chairman Jose Teodoro K. Limcaoco, current and incoming Board Members, representatives from the PESONet and InstaPay Automated Clearing Houses (ACHs), Clearing Switch Operators (Bancnet and PCHC) and BSP officials led by Deputy Governor Tangonan, Assistant Governor Redentor Bancod and Director Bridget Rose Mesina-Romero.

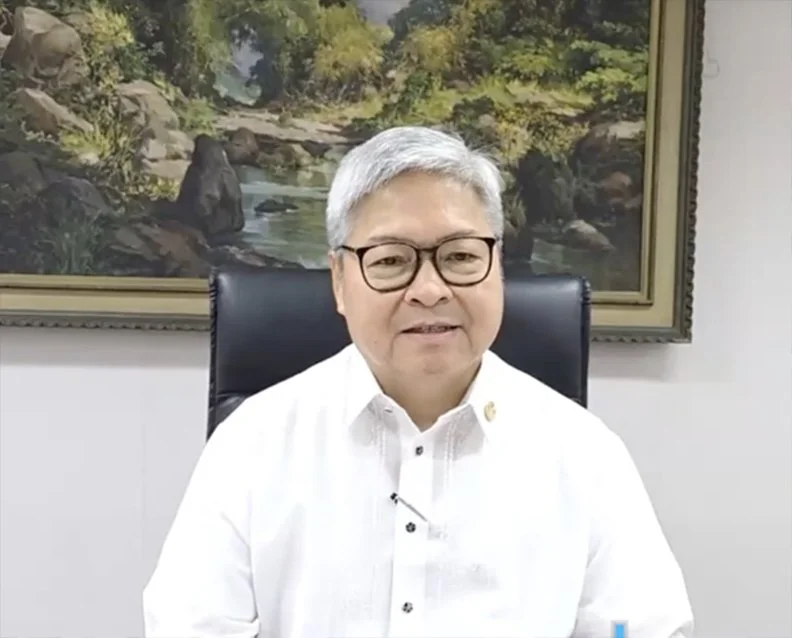

Deputy Governor Tangonan in his message commended PPMI for a significant milestone: digital payments now account for 52.8% of retail transactions. Setting a new target of 60–70% by 2028, he emphasized that while the first 50% was achieved by building infrastructure and proving digital's viability, the next phase requires building deeper trust, driving behavioral change, and promoting financial inclusion.

He also highlighted consumer concerns—such as transaction fees, security, merchant acceptance, and connectivity—and acknowledged PPMI's ongoing efforts to address them through initiatives such as the TRACE and ALERT fraud monitoring tools, request-to-pay, Direct Debit, and the cross-border Project Nexus.

Reaffirming BSP’s support under the National Payment Systems Act, Tangonan emphasized the vital stewardship role of PPMI in advancing digital payments, “You are not just industry leaders—you are payment system stewards,” he said. He also recognized the contributions of the outgoing Board and welcomed the new officers.

GM Araneta, speaking on behalf of President Co, presented PPMI’s achievements for 2024. As of December, PPMI had 161 members. InstaPay processed 1.4 billion transactions worth ₱7.3 trillion, peaking at 160 million in December. Key developments included QR Ph P2M branding, request-to-pay cash-in, expanded P2B use cases, and fraud tools TRACE and ALERT.

PESONet also recorded growth, with transactions increasing 10.73% to 100 million, totaling ₱10 trillion. Key milestones included the transition to a single DDA, three daily clearing cycles, and progress on a Direct Debit facility.

GM Araneta also outlined priority initiatives for 2025: account validation, AFASA protocols, expansion of Project Nexus, and the full rollout of Direct Debit.

Chairman Limcaoco closed by thanking PPMI Management, as well as the PESONet and InstaPay ACHs, for their continued efforts and commitment over the past year.

The Annual Membership Meeting concluded on a high note, underscoring BSP’s continued support, PPMI’s strong leadership, and the collective dedication of stakeholders namely the Universal/Commercial Banks, Thrift Banks, Rural Banks and Electronic Money Issuers (EMIs) or wallets, in driving digital innovation and achieving the national digitalization goal of 60–70% by 2028.

InstaPay Hits 1 Billion Transactions in 2024

October 2024

Milestone Alert: InstaPay has surpassed 1 billion transactions this year, totaling over P5.3 trillion in value—marking a major leap in digital payments adoption in the Philippines.

Contact Us

Ground Floor, Cafetorium Building

BSP Head Office, Mabini St. Manila

T: (632)8811-1277 loc 2035